After three weeks of falls, global share markets managed to rise over the last week helped by softer economic data easing concerns about higher for longer central bank interest rates, the ongoing interest in AI supported by strong sales at Nvidia and no hawkish surprises from Fed Chair Powell’s Jackson Hole speech. For the week US shares rose 0.8% and Eurozone and Japanese shares gained 0.6%. Worries about the Chinese growth outlook continued to weigh on the Chinese share market though and it fell 2%. Australian shares also fell 0.5% for the week amidst cautious earnings outlooks and ongoing concerns about China with falls in consumer staple, health, utility and energy shares leading the fall. Bond yields mostly eased back a touch after recent rises helped by softer global economic data. Oil prices also fell but metal and iron ore prices rose. The $A was little changed despite a further rise in the $US.

Weaker economic data is good news for now, but correction risks remain high. Slowing business conditions PMIs for August have provided confidence in the last week that central banks won’t have to increase interest rates further and this has taken some pressure off bond yields and supported global share markets. However, it’s too early to conclude that the correction in shares is over: the risk of recession remains high; China’s economy is still slowing; there is a risk that the disinflation process could pause in response to higher energy prices and sticky services inflation; central banks are still at risk of more hikes; there is a high risk of another US Government shutdown from 1 October; high bond yields are still pressuring share market valuations; and the weak seasonal period for shares goes out to October. We would regard further falls as part of a correction though and we retain a positive 12-month view on shares as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.

No surprises from Fed Chair Powell and ECB President Lagarde at Jackson Hole. Powell retained a tightening bias remaining tough on inflation, noting that it remains too high and that the Fed is prepared to hike further if appropriate but that its data dependent and in a position to proceed cautiously given lags, tighter financial conditions and the risk of doing too much. His comments did little to alter expectations that the Fed will leave rates on hold next month. Lagarde was hawkish on the medium to longer term outlook for inflation given energy/climate issues and geopolitical tensions potentially driving supply shocks to inflation and she noted that the ECB will set rates at “sufficiently restrictive levels for as long as necessary” but didn’t push back against market expectations for the ECB to leave rates on hold in September.

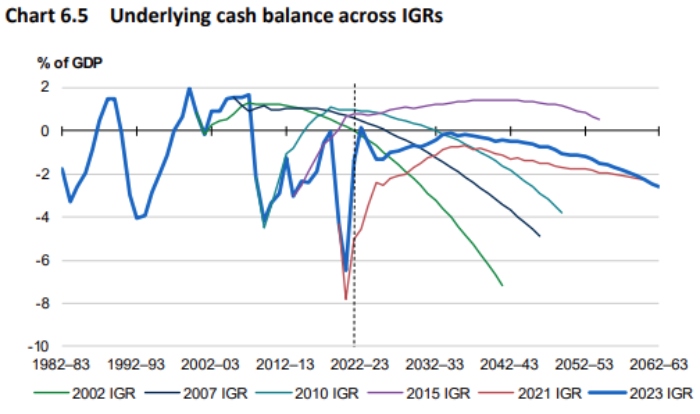

The main story from the Australian Government’s latest Intergenerational Report (IGR) is the need for more productivity enhancing economic reforms otherwise long-term growth will be even weaker than the slower growth that its now projecting. Key themes from the latest IGR are:

- A downgrade to projected GDP growth for the next 40 years to 2.2%pa compared to the last IGR in 2021 of 2.6%pa, mainly due to assumed lower productivity growth of 1.2%pa rather than 1.5%pa. This reflects the reality of the slowdown in productivity growth in recent times.

- Improved budget projections since the last IGR due to a better starting point (with the strong economic recovery and high commodity prices driving a budget surplus last financial year) but a renewed deterioration in the decades ahead as spending pressures mount. This results in somewhat improved but still high public debt projections.

- Key spending pressures are the NDIS, aged care, interest payments, health and defence. A key driver of growth in aged care and health spending is the aging of the population which is projected to see the share of the population aged 65 and over rise from 12% now to 18% in 40 years’ time.

- This is projected to push government spending as a share of GDP from 24.8% in 2022-23 to 28.6% in 40 years’ time which is well above its pre-pandemic average. All things equal, a bigger government share of GDP means a less productive economy.

- A falling reliance on indirect tax (with falling fuel & tobacco excise) and rising reliance on personal income tax collections (partly reflecting bracket creep). The increased tax burden placed on workers will further reduce the efficiency of the tax system and raised questions of equity.

- The IGR also assumes that long term bond yields rise to around the level of nominal GDP growth of 4.6%pa over the long term. Since long term bond yields reflect expectations of the RBA’s cash rate over time this provides a reminder that over the long term, interest rates and hence mortgage rates are likely to be higher than they were in the years up until the pandemic. This will be a source of downwards pressure on property values.

The challenges of an aging population have long been a theme of IGRs over the last 20 years and so are nothing new, but the decline in productivity growth is a big concern as it means slower growth in living standards. It may seem academic and hard to comprehend, but the now projected 1.2%pa growth in productivity will mean that GDP per person in 40 years’ time will be 11.2% lower than if productivity ran at the previous projected level of 1.5%pa. If productivity growth is in line with the average of the last decade of just 0.8%pa, per capita GDP will be 24.2% lower than otherwise in 40 years’ time. While the Government is focussing on things like skills, the opportunities that flow from the move to net zero, supporting the adoption of new technology and now competition policy, much more needs to be done in terms of tax reform (with Australia set to rely even more on distortionary income tax v indirect tax), labour market flexibility and improving public sector productivity.

Finally on the IGR, this next chart highlights the better budget position versus the last IGR in 2021 but also why the projections need to be treated with a lot of caution as they blow around a lot with each new IGR!

Source: Australian Treasury

Economic activity trackers

Our Economic Activity Trackers are still not providing any decisive indication of recession (or a growth rebound).

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

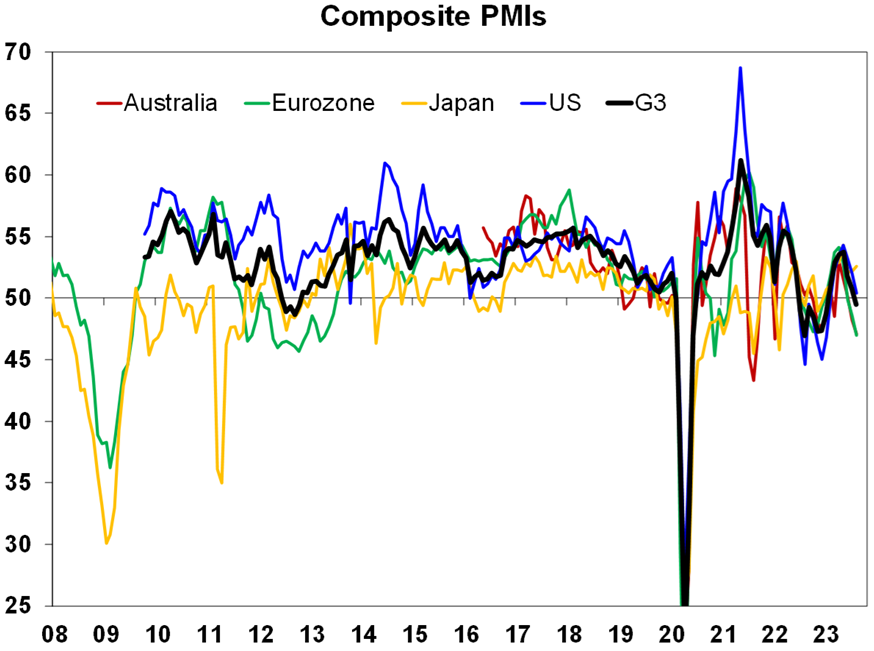

Goldilocks rapidly fading! Business conditions PMIs fell again in August in the US, Eurozone, UK and Australia with services conditions now rapidly catching down to manufacturing, that was already in negative territory. Japan is the exception reflecting its later reopening and absence of monetary tightening so far. But the global rebound from late last year is clearly over as rate hikes globally continue to impact highlighting that the risk of recession remains very high.

Source: Bloomberg, AMP

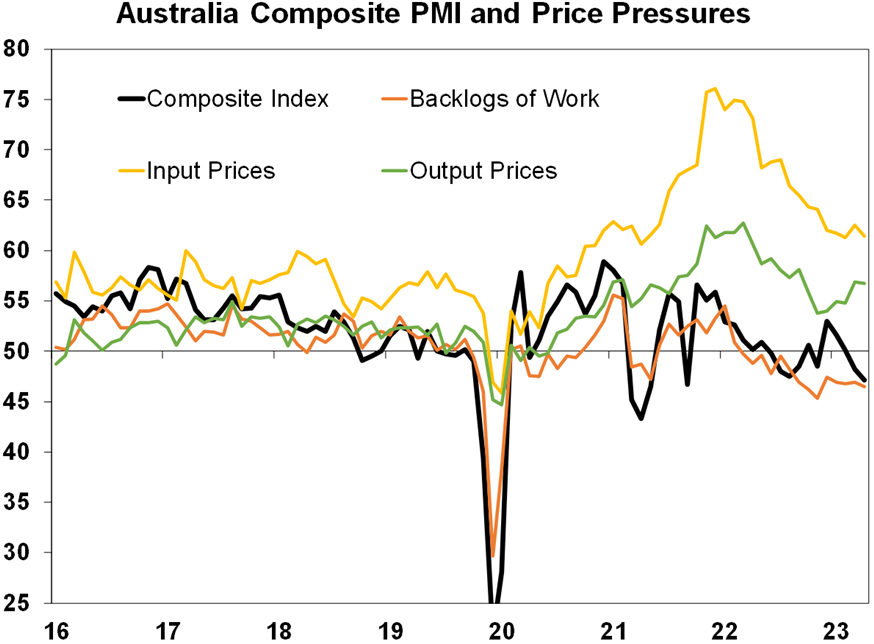

With the downswing in business conditions, pricing pressures are well down from their 2021-22 highs and are continuing to recede. Input prices across the G3 (US, Europe and Japan) rose in August reflecting a rise in oil and gas prices, but output prices slipped slightly, order backlogs are well down from their 2021-22 highs and delivery times remain much improved which is all consistent with an ongoing easing in inflationary pressures albeit there is still a way to go yet. The ongoing signs of weakening economic conditions and easing price pressures are consistent with the Fed and ECB leaving interest rates on hold at their September meetings, albeit the threat of more hikes from both will likely remain on the table for a while yet.

Source: Bloomberg, AMP

Apart from the weak PMI’s other US economic data was mostly soft too. Jobless claims fell and new home sales rose in July, but existing home sales fell as did new mortgage applications which suggests that the renewed rise in US mortgage rates is starting to weigh on US housing indicators again. Underlying capital goods orders and shipments for July were also soft pointing to weak business investment.

German producer prices fell 6% over the year to July, down from a high of +45%yoy in producer price inflation last year. While higher gas prices will boost producer prices this month note that the gas price is still way down on last year’s high.

Another modest PBOC easing. The Chinese central bank eased monetary policy further – cutting its 1-year prime rate by 0.1% to 3.45% – but this was by less than expected and it left its 5-year prime lending rate unchanged at 5.2%. Both of these impact bank lending rates and the continuing modest nature of policy easing remains a concern. However, if China’s problem is that borrowers don’t want to borrow more (because of property problems etc) then cutting rates may not make a big difference any way and the Government may just be waiting for a better opportunity to provide more forceful fiscal stimulus. Given the risk of social unrest if the economy continues to slow and the property market weakens further, it’s hard to see the Chinese Government not providing more aggressive stimulus at some point soon.

Australian economic events and implications

Australian business conditions PMIs for August fell again taking the composite index further below the 50 growth/contraction level with a sharp fall in services conditions. Price and cost pressures edged down a bit and are well down from their highs but still remain elevated, but at least they are not as concerning as in the July NAB business survey. Order backlogs are continuing to improve.

Source: Bloomberg, AMP

New home sales as surveyed by the Housing Industry Association remain depressed with the 3-month average to July running down 33%yoy, consistent with depressed building approvals in pointing to slower home building activity ahead.

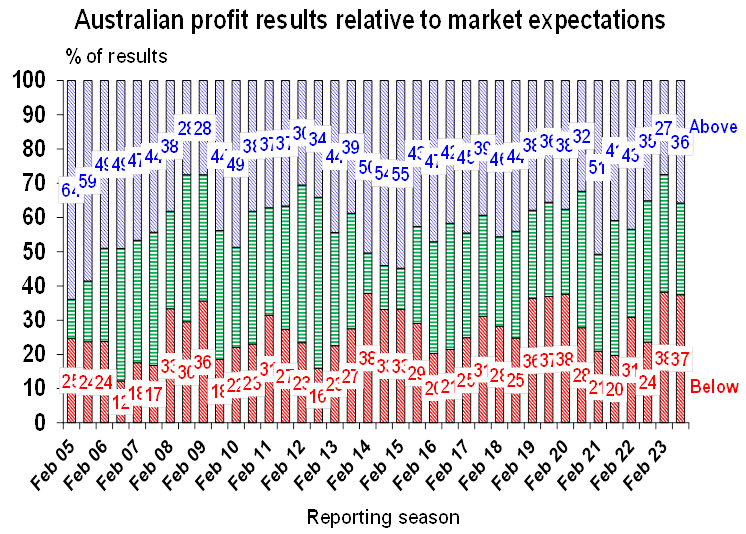

The Australian June half earnings reporting season is now about 85% done in terms of companies and 92% done in terms of market capitalisation. It’s been a better than feared but expectations are still getting revised down on the back of cautious corporate guidance.

- Upside and downside surprises have been neck and neck with about 36% surprising on the upside which is below the norm of 43% and 36% surprising on the downside which is more than the norm of 26%.

Source: AMP

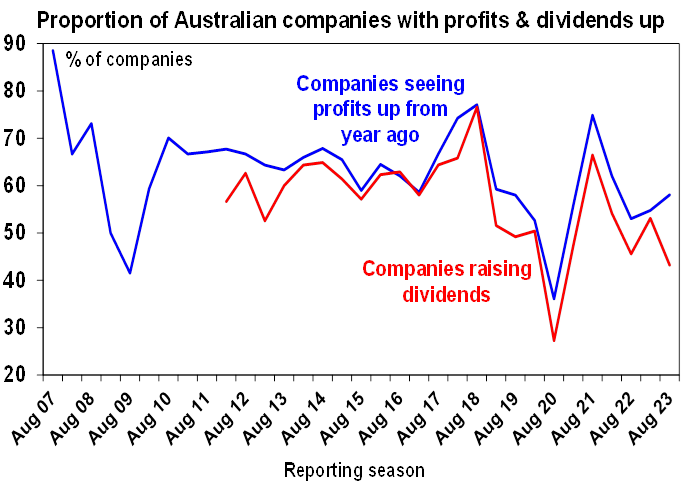

- 58% of companies have seen earnings rise on a year ago, but this is below the norm of 63%.

- Only 43% have increased their dividends on a year ago which is less than the norm of 58%, suggesting a degree of caution.

Source: AMP

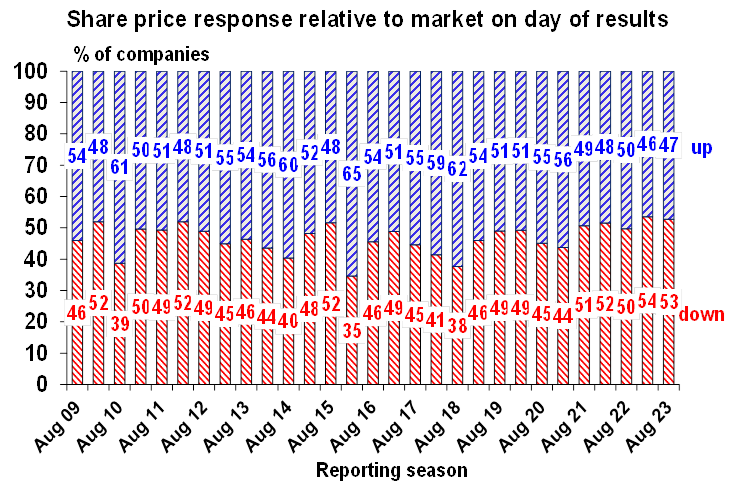

- And less companies than normal have seen their share price outperform the market on the day they reported.

Source: AMP

Key themes from the earnings results have been that: cost pressures remain a challenge although there are some signs they are easing; building material companies are still benefitting from strong activity although some are warning of a slowdown; insurers are seeing margin improvement (at the expense of their customers with big premium increases); so far home borrowers are keeping up their payments (but rate hikes have yet to fully flow through); and corporate guidance has been cautious with more negative than positive guidance and retailers in particular are warning of tougher conditions and better off customers turning to discount stores (like Big W and K Mart) for bargains. Partly reflecting the cautious outlook guidance consensus earnings expectations have been revised down since the reporting season started. The consensus is now for a +1.5% rise in earnings for 2022-23 and for a -5.7% fall in earnings in 2023-24, with both revised down from +2.5% and -0.8% respectively at the end of July.

What to watch over the next week?

In the US, August jobs data (Friday) is expected to show a further slowing in payroll growth to 170,000 and wages growth to 4.3%yoy but unemployment unchanged at 3.5%. In other data expect consumer confidence to be little changed for August, home price data to show a further rise and job openings to remain in a downtrend (all Tuesday), personal spending and income data for July to show continued modest growth with core private final consumption inflation data showing another 0.2%mom rise but annual growth rising slightly to 4.2%yoy (Thursday) and the August ISM manufacturing conditions index rising slightly to a still soft level of 47 (Friday).

Eurozone core inflation data for August is expected to show a further fall to 5%yoy with unemployment likely unchanged at 6.4% (both Thursday) and economic confidence data for July (Wednesday) is expected to fall in line with weaker PMIs.

Japanese data is expected to show that the jobs market (Tuesday) and retail sales growth (Thursday) remain reasonably strong but with industrial production likely to fall (Thursday).

Chinese business conditions PMIs (Thursday and Friday) for August are likely to remain subdued.

In Australia, the focus will be once again on inflation with the July Monthly CPI Indicator (due Wednesday) likely to rise to 5.5%yoy from 5.4%yoy reflecting higher electricity and gas prices partly offset by various power bill subsidies and slightly lower petrol prices. With the downtrend from the 8.4%yoy high in December remaining in place and higher power prices well known we don’t expect this to alter prospects for the RBA to leave interest rates on hold next month. A speech by soon to be RBA Governor Michele Bullock (Tuesday) will also be watched for any clues on the interest rate outlook, although the title is “Climate Change and Central Banks”. Meanwhile expect July retail sales (Monday) to show a 0.1% gain after a 0.8% fall in June, building approvals to rise 2% and June quarter construction to rise 1%qoq (Wednesday), credit growth to remain modest and business investment to fall 0.3%qoq (Thursday), CoreLogic data for August to show a further 1% rise in capital city home prices and housing finance to fall 0.5%mom (Friday).

The Australian June half profit reporting season will wrap up with about 40 major companies reporting, including Fortescue Meals (Monday), Mineral Resources and Cooper Energy (Tuesday), Brambles (Wednesday) and Harvey Norman (Thursday).

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the next few months shares are at high risk of a correction given high recession and earnings risks, the risk of still more hikes from central banks, rising bond yields and poor seasonality out to September/October.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish, but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the lagged impact of the rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we revised up our national average home price forecast for this calendar year to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down on the back of the impact of high interest rates and higher unemployment.

Cash and bank deposits are expected to provide returns of around 4%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of a less hawkish RBA and weak growth in China, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.